Managing finances has never been easier, thanks to the growing number of money transfer apps that combine speed, security, and convenience. Whether you’re paying friends, sending money internationally, or managing business transactions, the right app can make all the difference. Here’s a comprehensive list of the 10 best money transfer apps in the USA for 2025, focusing on features, user experience, and reliability.

Best Money Transfer Apps in USA

1. PayPal

PayPal is one of the most trusted platforms for transferring money worldwide. Known for its robust security and seamless integration, it is widely used for personal and business transactions. Here’s a detailed guide on how to use PayPal, from signing up to making your first transfer.

How to Sign Up for PayPal?

- Visit the PayPal Website or Download the App

- Choose Your Account Type

- You can select between a Personal Account (ideal for sending/receiving money and online shopping) or a Business Account (for merchants and e-commerce integration).

- Enter Your Information

- Provide your email address, create a strong password, and fill in details like your name, address, and phone number.

- Link Your Payment Method

- Add a bank account, credit card, or debit card to fund your transactions. This step also allows you to withdraw received funds to your bank account.

- Verify Your Email Address

- PayPal will send a verification email. Click the link in the email to confirm your address.

- Set Up Two-Factor Authentication (Optional but Recommended)

- For added security, enable two-factor authentication under your account settings.

How to Use PayPal for Money Transfers?

Sending Money:

- Log in to your PayPal account.

- Click on “Send & Request” at the top menu.

- Enter the recipient’s email address or phone number.

- Type the amount you want to send and select the currency.

- Choose the payment method (e.g., PayPal balance, bank account, or card).

- Review the transaction details and click “Send Money”.

Receiving Money:

- Share your registered email address or phone number with the sender.

- You’ll receive an email or app notification once the payment is sent.

- Log in to your account to view the funds, which you can leave in PayPal or transfer to your linked bank account.

Paying for Goods or Services Online:

- Select “Pay with PayPal” at checkout on supported websites.

- Log in to your PayPal account when prompted.

- Confirm the payment details and complete your purchase.

How PayPal Protects Your Transactions?

PayPal offers extensive buyer and seller protection, fraud monitoring, and encryption to ensure safe transactions. Key features include:

- Purchase Protection: Refunds for unauthorized purchases or items not received.

- Fraud Detection: Real-time monitoring of accounts for unusual activities.

- Encryption: All transactions are encrypted to prevent data breaches.

PayPal Fees

- Personal Transfers: Free within the USA when funded by a bank account or PayPal balance.

- Credit/Debit Card Transfers: Subject to a small fee (typically 2.9% + $0.30 per transaction).

- Currency Conversion: Includes a currency conversion fee for international transactions.

Who Can Benefit from PayPal?

- Individuals: For sending money to friends and family or online shopping.

- Freelancers and Entrepreneurs: To receive payments from clients.

- Businesses: For accepting payments online and managing customer transactions.

Read Also: 10 Best Cryptocurrency to Invest in 2025

2. Venmo

Venmo, a service owned by PayPal, is one of the most popular peer-to-peer (P2P) payment apps in the USA. Its user-friendly design, integrated social features, and fast transfers make it a favorite for splitting bills, reimbursing friends, and sharing everyday expenses.

How to Sign Up for Venmo?

- Download the Venmo App

- Venmo is available on the Apple App Store and Google Play Store. Download and install the app on your mobile device.

- Create an Account

- Open the app and click on “Sign Up”.

- Enter your email address or phone number, create a secure password, and provide your personal information such as name and date of birth.

- Link Your Payment Methods

- Add a bank account, credit card, or debit card to fund transactions or withdraw received money.

- Venmo supports instant verification for most banks, simplifying the setup process.

- Verify Your Identity

- For security and compliance, Venmo may ask you to verify your identity by submitting a photo ID. This is especially important if you plan to use higher transaction limits.

How to Use Venmo for Transactions?

Sending Money:

- Open the app and tap “Pay or Request”.

- Enter the recipient’s username, phone number, or email address.

- Add the amount and a note describing the payment (e.g., “Dinner bill”).

- Select your payment method and tap “Pay”.

Requesting Money:

- Go to the “Pay or Request” option.

- Enter the payer’s information.

- Specify the amount and add a note explaining the purpose (e.g., “Movie tickets”).

- Tap “Request” and wait for the payment.

Splitting Bills:

- Use Venmo’s split feature to divide bills among multiple users. Select the transaction, choose “Split,” and Venmo will calculate and request amounts automatically.

Key Features of Venmo

- Social Feed:

Venmo’s social feed lets users view and share transaction descriptions (e.g., “Paid John for pizza”). You can adjust privacy settings to keep transactions private. - Instant Bank Transfers:

Funds can be transferred to your bank account within minutes for a small fee. Standard transfers take 1-3 business days and are free. - Merchant Acceptance:

Venmo is accepted at various online and physical merchants, enabling users to shop and pay conveniently. - Venmo Debit Card:

- Users can order a Venmo debit card linked to their Venmo balance.

- The card can be used for purchases and ATMs in the USA.

- Business Payments:

Small businesses can accept Venmo payments by integrating the app with their point-of-sale system.

Fees Associated with Venmo

- Standard Transfers: Free (1-3 business days).

- Instant Transfers: 1.75% fee (minimum $0.25, maximum $25).

- Credit Card Payments: 3% transaction fee.

- Venmo Debit Card: Free for purchases, but ATM withdrawals may incur fees.

Who Should Use Venmo?

- Individuals: Ideal for personal transactions like splitting rent or paying for meals.

- Friends and Family: Simplifies sharing expenses without cash.

- Small Businesses: Convenient for accepting mobile payments from customers.

Read Also: 13 High-Income Skills to Learn in 2025

3. Cash App

Cash App, developed by Block, Inc. (formerly Square Inc.), is more than just a money transfer app—it’s a versatile tool for managing your finances. With unique features like Bitcoin trading, stock investments, and a customizable debit card, Cash App has become a favorite for both personal and financial transactions in the USA.

How to Sign Up for Cash App?

- Download the App

- Cash App is available for download on the Apple App Store and Google Play Store.

- Create an Account

- Open the app and enter your phone number or email address to start the sign-up process.

- Link a Payment Method

- Add a bank account or a debit card to fund your transactions or withdraw funds.

- You can skip this step initially and add it later under account settings.

- Choose a $Cashtag

- Create your unique $Cashtag, which acts as your personalized payment link for others to send you money easily.

- Verify Your Identity

- For added security and to unlock advanced features (like Bitcoin trading and increased transaction limits), complete the identity verification process by providing your full name, date of birth, and the last four digits of your SSN.

How to Use Cash App for Money Transfers?

Sending Money:

- Open the app and tap the “$” icon.

- Enter the amount you wish to send and tap “Pay”.

- Type the recipient’s $Cashtag, email, or phone number.

- Add a note for the payment and hit “Pay”.

Requesting Money:

- Tap the “$” icon and enter the amount you need.

- Click “Request” and select the recipient.

- Once the request is sent, you’ll be notified when the payment is made.

Key Features of Cash App

- Bitcoin and Stock Trading:

- Buy, sell, and hold Bitcoin directly from the app.

- Invest in stocks with as little as $1 using fractional shares.

- Free Debit Card:

- Order a customizable Cash Card linked to your Cash App balance.

- The card supports ATM withdrawals and is compatible with contactless payments.

- Customizable $Cashtag:

- Your $Cashtag acts as a unique payment ID, making transactions fast and simple.

- Direct Deposits:

- Receive paychecks and other deposits directly into your Cash App account.

- Access funds up to 2 days earlier than traditional banks.

- Boost Discounts:

- Use your Cash Card for exclusive discounts (called “Boosts”) at partner merchants.

How to Use Cash App for Investments?

Bitcoin Trading:

- Navigate to the Bitcoin tab and follow prompts to purchase or sell Bitcoin.

Stock Investments:

- Go to the Investments tab, search for stocks, and start investing with just $1.

Cash App Fees

- Standard Transfers to Bank Accounts: Free (1-3 business days).

- Instant Transfers: 0.5%–1.75% fee (minimum $0.25).

- Bitcoin Transactions: Includes a service fee and an additional fee based on market activity.

Who Should Use Cash App?

- Individuals: Ideal for sending and receiving money quickly.

- Investors: Offers an easy entry into Bitcoin and stock trading.

- Freelancers and Gig Workers: Simplifies receiving payments through direct deposits or $Cashtag.

Read Also: 12 Crazy AI Tools for Social Media in 2025

4. Zelle

Zelle is a peer-to-peer payment system seamlessly integrated with many major US banks. Its real-time money transfers, zero fees for domestic transactions, and direct bank integration make it an excellent choice for fast and secure financial transactions.

How to Sign Up for Zelle

- Check Your Bank App

- Many US banks, including Chase, Bank of America, and Wells Fargo, already have Zelle integrated into their mobile banking apps.

- If your bank supports Zelle, no separate signup is needed—simply log in to your bank’s app to get started.

- Download the Zelle App (Optional)

- If your bank doesn’t support Zelle, you can download the standalone Zelle app from the Apple App Store or Google Play Store.

- Enroll Your Account

- Link your checking account or debit card to Zelle.

- Provide your email address or phone number, which will act as your payment ID for sending and receiving money.

How to Use Zelle for Transactions

Sending Money:

- Log in to your bank’s app or the Zelle app.

- Navigate to the Zelle feature and select “Send Money”.

- Enter the recipient’s email address or phone number linked to their Zelle account.

- Input the amount and confirm the transfer. The funds will be delivered in minutes.

Receiving Money:

- The sender only needs your email or phone number registered with Zelle.

- Once the transfer is initiated, the funds will appear in your bank account, often within minutes.

Splitting Bills:

- Zelle allows you to split expenses with multiple recipients. Simply choose the “Split” option and select the contacts, then Zelle will divide the amount evenly.

Key Features of Zelle

- Real-Time Transfers:

- Unlike traditional transfers, Zelle ensures instant delivery of funds, making it ideal for urgent payments.

- No Fees:

- Zelle doesn’t charge for sending or receiving money, though your bank might have separate policies, so it’s worth checking.

- Direct Bank Integration:

- Many US banks have built-in Zelle functionality, eliminating the need for a third-party app.

- Security Measures:

- Transfers are encrypted, and you never need to share sensitive banking details with recipients—just your email or phone number.

Who Should Use Zelle?

- Individuals Sharing Expenses:

- Ideal for splitting rent, utility bills, or group purchases among friends or roommates.

- Small Businesses:

- Perfect for businesses that want to avoid credit card fees and need quick payments.

- Frequent Domestic Users:

- Since Zelle is only available for transactions within the USA, it’s perfect for domestic financial needs.

Tips for Maximizing Zelle

- Keep Contact Information Updated:

- Ensure your email and phone number are current to avoid payment delays.

- Verify Recipients:

- Always double-check the recipient’s email or phone number before confirming a transaction.

- Be Cautious with Unknown Contacts:

- Zelle transfers are instant and irreversible, so avoid sending money to unknown parties.

Read Also: 10 Best Online Side Hustles to Start in 2025

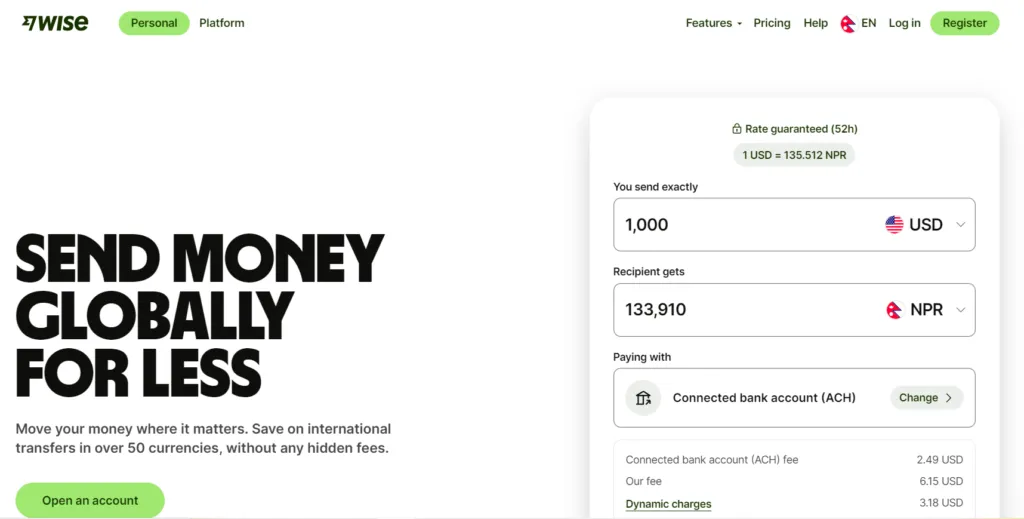

5. Wise (formerly TransferWise)

Wise (formerly known as TransferWise) has revolutionized international money transfers with its low fees, real-time exchange rates, and seamless global banking solutions. It’s the go-to app for anyone needing fast, reliable, and cost-effective cross-border payments.

How to Sign Up for Wise

- Download the Wise App

- Available on both Apple App Store and Google Play Store, or you can access Wise through its website.

- Create an Account

- Use your email address to create a free account.

- Set up a strong password for your security.

- Verify Your Identity

- Upload a government-issued ID (e.g., passport or driver’s license) to comply with financial regulations.

- Some transfers may require additional verification, such as proof of address.

- Add Payment Details

- Link your bank account or debit card for funding transfers. You can also receive payments by sharing your Wise account details.

How to Use Wise for International Transfers

- Start a Transfer:

- Log into your account, select “Send Money,” and input the amount and currency you want to send.

- Enter Recipient Details:

- Provide the recipient’s name and bank account details (e.g., IBAN, SWIFT code, or local bank details, depending on the country).

- Review and Confirm:

- Wise will display the exact fee, exchange rate, and estimated delivery time.

- Confirm the details and authorize the payment.

- Track Your Transfer:

- Wise provides real-time updates so you can track the progress of your transaction.

Key Features of Wise

- Low-Cost International Transfers:

- Wise uses the mid-market exchange rate without hidden markups, ensuring you get the best value for your money.

- Multi-Currency Accounts:

- Open and hold balances in over 50 currencies.

- Use this feature to pay or get paid like a local, reducing conversion fees.

- Borderless Debit Card:

- Wise offers a debit card that supports multiple currencies, perfect for travelers or freelancers working with international clients.

- Spend directly in the local currency wherever you go.

- Transparent Fees:

- You’ll see the transfer cost upfront, with no surprise charges.

Who Should Use Wise?

- Frequent Travelers:

- Save money on exchange rates and ATM withdrawals abroad.

- International Freelancers & Remote Workers:

- Receive payments in multiple currencies and avoid hefty conversion fees.

- Businesses:

- Use Wise Business for managing international payrolls, paying invoices, or holding funds in different currencies.

- Students & Expats:

- Ideal for tuition payments or sending money to loved ones abroad.

Tips for Maximizing Wise

- Set Alerts for Exchange Rates:

- Wise can notify you when rates are favorable for a transfer.

- Use the Multi-Currency Account:

- Keep funds in the currency you use frequently to save on conversions.

- Plan Transfers Ahead:

- While Wise is fast, some transfers may take 1-2 days. Planning can save you from rush fees.

Why Choose Wise?

- Trustworthy Platform: Regulated by financial authorities worldwide.

- Wide Coverage: Available in 70+ countries and supports over 1,000 currency routes.

- Eco-Friendly: Wise has pledged to become carbon-neutral, appealing to environmentally conscious users.

Read Also: 10 Best Small Businesses to Start in 2025

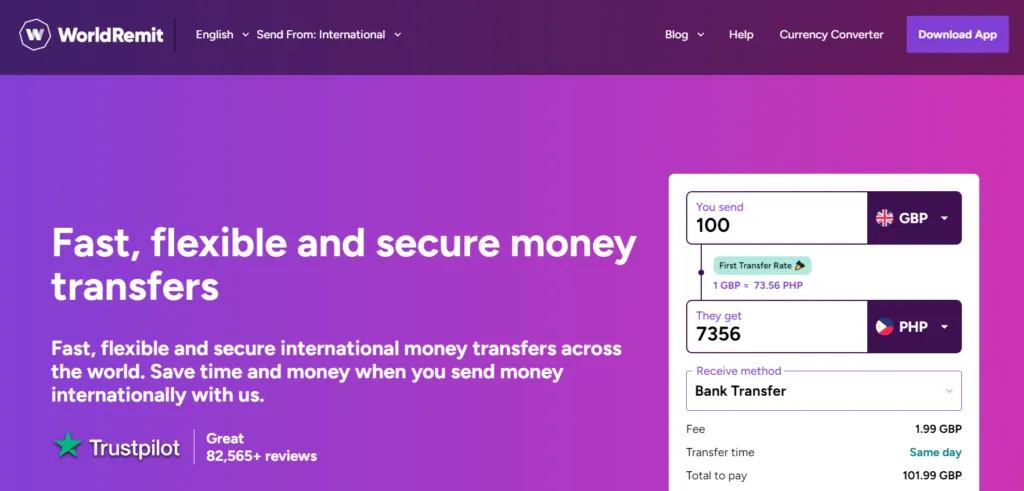

6. WorldRemit

WorldRemit has gained a reputation as one of the most versatile money transfer platforms, specializing in international transfers to over 130 countries. With multiple payment methods and convenient features like cash pickups and airtime top-ups, WorldRemit is perfect for those seeking speed, flexibility, and global reach.

How to Sign Up for WorldRemit

- Create an Account

- Visit the WorldRemit website or download the app from the Apple App Store or Google Play Store.

- Provide your email address, name, and country of residence to register.

- Set a secure password.

- Verify Your Identity

- Upload a government-issued ID (passport, driver’s license, or national ID) to comply with regulations.

- Verification is often processed quickly, but it’s good to complete this step in advance for smoother transactions.

- Set Up Payment Details

- Link your bank account, debit card, or other payment methods supported by WorldRemit.

How to Use WorldRemit for Transfers

- Choose the Destination Country:

- Start by selecting the country you want to send money to.

- WorldRemit supports transfers to over 130 countries, each with specific delivery options.

- Select the Transfer Type:

- Options include bank deposits, cash pickups, mobile wallets, or even mobile airtime top-ups.

- Choose the method that suits the recipient’s needs.

- Enter Recipient Details:

- Provide the recipient’s name, contact information, and payment details based on the chosen method (e.g., bank account or mobile wallet information).

- Confirm and Pay:

- Review the transaction details, including fees and exchange rates.

- Confirm the transfer and complete the payment using your linked account or card.

- Track the Transaction:

- WorldRemit provides real-time updates, so you’ll know when the recipient receives the funds.

Key Features of WorldRemit

- Transfers to Over 130 Countries:

- WorldRemit’s global reach makes it ideal for families, businesses, and students sending or receiving funds internationally.

- Cash Pickup and Mobile Wallets:

- Recipients can collect cash from partnered locations or receive funds directly in their mobile wallets.

- Mobile Airtime Top-Ups:

- A unique feature allowing you to send airtime credits to mobile phones—a practical option for staying connected.

- Instant or Same-Day Transfers:

- Depending on the country and method, transfers are processed within minutes or on the same day.

- Affordable Fees and Transparent Rates:

- WorldRemit is upfront about fees and exchange rates, ensuring no hidden costs.

Who Should Use WorldRemit?

- Expats and Migrants:

- Ideal for sending money to family members in countries with cash pickup locations or mobile wallet support.

- Small Businesses:

- Convenient for paying overseas suppliers or remote team members.

- Travelers:

- Perfect for topping up airtime or accessing funds through local cash pickup options.

- Students:

- Useful for tuition payments or receiving financial support from abroad.

Tips for Maximizing WorldRemit

- Compare Delivery Methods:

- Fees and delivery times vary by method, so choose the option that’s fastest and most cost-effective.

- Use Promo Codes:

- WorldRemit often offers discounts for new users or special promotions during holidays.

- Keep Recipient Information Accurate:

- Double-check details to avoid delays or errors in delivery.

Why Choose WorldRemit?

- Convenience and Variety: Multiple transfer methods cater to diverse user needs.

- Global Network: Reliable service in over 130 countries.

- Speed: Many transfers are completed instantly or within the same day.

Read Also: 7 Top Ways to Make Money with AI in 2025

7. Google Pay

Google Pay is not just a payment app but a comprehensive digital wallet that simplifies money transfers, bill payments, and even in-store purchases. Backed by Google’s robust security measures, it’s a reliable choice for seamless and secure financial transactions.

How to Sign Up for Google Pay

- Download the App:

- Google Pay is available on both the Apple App Store and Google Play Store for Android devices.

- Set Up an Account:

- Log in with your Google account.

- Provide your mobile number and verify it with the OTP sent via SMS.

- Add Payment Methods:

- Link your bank account using your debit card or enable UPI if supported.

- Alternatively, add a credit card or debit card for seamless payments.

- Customize Your Profile:

- Add a profile photo or set up loyalty cards, gift cards, and even transit passes for added convenience.

How to Transfer Money Using Google Pay

- Send Money to Friends or Family:

- Tap on “Send” and search for the recipient by their phone number, email, or UPI ID.

- Enter the amount, choose a payment method, and confirm the transfer.

- Pay Merchants or Online Stores:

- Google Pay integrates with countless online retailers and brick-and-mortar stores.

- Use the “Scan QR” feature to make instant payments to supported merchants.

- Schedule Recurring Payments:

- Set up automatic payments for bills, subscriptions, or rent directly within the app.

- Receive Money:

- Share your unique UPI ID or allow others to find you using your registered mobile number.

Key Features of Google Pay

- Secure and Free Transfers:

- Enjoy no-fee transactions for personal transfers, making it cost-effective for everyday use.

- Integration with Android Devices:

- Google Pay is pre-installed on most Android devices, ensuring compatibility and ease of use.

- Loyalty Cards and Discounts:

- Save and redeem loyalty points, gift cards, and promotional discounts directly within the app.

- Wide Acceptance:

- Google Pay works at millions of in-store and online merchants in the USA.

- Enhanced Security:

- Utilizes Google’s advanced encryption and tokenization technology to protect your data.

- Supports biometric authentication like fingerprints and face recognition for an added layer of security.

Who Should Use Google Pay?

- Everyday Users:

- Perfect for paying friends, splitting bills, or handling daily expenses seamlessly.

- Retail Shoppers:

- Simplifies checkout at retailers that accept Google Pay with just a tap on your phone.

- Online Buyers:

- Enjoy secure and quick payments on e-commerce platforms that integrate Google Pay.

- Small Business Owners:

- Ideal for receiving payments from customers without the need for a card-swiping machine.

Tips to Maximize Google Pay

- Save Payment Info for Convenience:

- Store multiple cards and bank accounts for faster transactions.

- Utilize Rewards:

- Google Pay offers cashback, referral bonuses, and discounts for frequent users.

- Track Spending:

- Use the app to monitor your transaction history and maintain better control of your finances.

Why Choose Google Pay?

- Ease of Use: Intuitive interface for quick setup and effortless navigation.

- No Hidden Fees: Enjoy free transfers for personal payments.

- Global Presence: Works in over 40 countries, making it a versatile choice for travelers.

Read Also: 10 Best Interactive eBook Creation Tools in 2025

8. Apple Pay

Apple Pay is Apple’s secure and efficient payment platform, allowing seamless money transfers and purchases for iPhone, iPad, and Apple Watch users. With encrypted transactions and Siri integration, Apple Pay ensures privacy and convenience for users in the Apple ecosystem.

How to Set Up Apple Pay

- Open Wallet App:

- On your iPhone, open the Wallet app.

- Tap the “+” icon to add a card.

- Add a Payment Method:

- Use your device’s camera to scan a debit or credit card, or manually enter the card details.

- Follow the on-screen prompts to verify your card with your bank.

- Enable Apple Pay:

- Once verified, your card will be added to Wallet, and you can begin using Apple Pay for transactions.

- Activate on Other Devices:

- Set up Apple Pay on your Apple Watch through the Watch app on your iPhone.

- On iPads or Macs, follow similar steps through Wallet & Apple Pay settings.

How to Transfer Money Using Apple Pay

- Send Money with Apple Pay Cash:

- Open the Messages app on your iPhone.

- Select a conversation or start a new one.

- Tap the Apple Pay button in the app drawer, enter the amount, and confirm the transfer.

- Ask Siri for Transfers:

- Activate Siri and say, “Send $50 to [Name] using Apple Pay.”

- Confirm the payment details when prompted.

- Receive Payments:

- Money sent to you is added to your Apple Cash card in Wallet, which you can use immediately for purchases or transfer to a bank account.

- Use for Purchases:

- At checkout, hold your iPhone near the payment terminal and use Face ID or Touch ID to confirm the transaction.

- For online or in-app purchases, select Apple Pay as the payment method and authenticate.

Key Features of Apple Pay

- Works Exclusively with Apple Devices:

- Apple Pay is optimized for the iPhone, iPad, Mac, and Apple Watch, ensuring seamless performance within the Apple ecosystem.

- Encrypted Transactions:

- Uses tokenization to protect card details, ensuring every transaction is private and secure.

- Siri Integration:

- Simplify payments by using Siri voice commands for hands-free convenience.

- Supports Loyalty Cards and Rewards:

- Save loyalty cards, boarding passes, and event tickets in Wallet for easy access.

- Wide Acceptance:

- Apple Pay is accepted at millions of locations, including in-store, online, and in-app merchants.

Who Should Use Apple Pay?

- Apple Device Owners:

- Essential for iPhone, iPad, and Apple Watch users who want a fast, integrated payment solution.

- Privacy-Conscious Individuals:

- Ideal for those prioritizing secure, encrypted payments.

- Shoppers:

- Perfect for online purchases or in-store payments at retailers accepting contactless transactions.

Tips for Maximizing Apple Pay

- Use Face ID or Touch ID:

- Enhance security by enabling biometric authentication for transactions.

- Link Multiple Cards:

- Add several cards to Wallet for flexibility in choosing payment methods.

- Leverage Siri:

- Speed up transactions by using voice commands for payments or purchases.

Why Choose Apple Pay?

- Integration: Works effortlessly across Apple devices.

- Security: Offers robust privacy protections through encryption and tokenization.

- Convenience: Simplifies daily transactions with contactless and digital payments.

Read Also: How to Write an eBook and Make Money in 2025

9. Remitly

Remitly has carved its niche as one of the most trusted platforms for remittances, offering speed, security, and competitive rates for international money transfers. With its focus on global transfers, Remitly is an ideal choice for users sending money to family or friends abroad.

How to Sign Up for Remitly

- Download the App:

- Available on both the Google Play Store and Apple App Store.

- Create an Account:

- Open the app, click on “Sign Up,” and enter your email address.

- Set a password and select your country of residence.

- Verify Your Identity:

- Depending on the amount you plan to send, Remitly may require you to verify your identity with a valid ID (e.g., passport, driver’s license).

- Add Payment Method:

- Link your bank account, debit card, or credit card for seamless payments.

How to Send Money with Remitly

- Choose the Destination:

- Select the country you want to send money to. Remitly supports over 100 destinations globally.

- Enter the Amount:

- Specify the amount to send and choose your preferred currency.

- Select a Delivery Method:

- Bank Deposit: Transfer directly to the recipient’s bank account.

- Cash Pickup: The recipient can collect cash at designated locations.

- Mobile Money: Send money to mobile wallets in supported countries.

- Provide Recipient Details:

- Enter the recipient’s name, contact number, and banking or wallet information.

- Confirm and Send:

- Review the details, choose the transfer speed (Express or Economy), and complete the payment.

Key Features of Remitly

- Multiple Delivery Options:

- Offers diverse methods such as bank deposits, cash pickups, mobile wallets, and home deliveries (in select countries).

- Competitive Exchange Rates:

- Provides better rates compared to traditional banks, ensuring recipients get more money.

- Real-Time Tracking:

- Track transfers from initiation to completion with live updates.

- Fast Delivery:

- Express transfers arrive within minutes, while Economy options are ideal for cost savings.

- Customer Support:

- 24/7 multilingual support for assistance with transactions.

Who Should Use Remitly?

- Expats and Migrants:

- Ideal for those sending money to support family or friends in their home countries.

- Travelers and Freelancers:

- Beneficial for those needing fast cross-border payments.

- Global Businesses:

- A convenient option for transferring funds to international partners or freelancers.

Tips to Maximize Remitly’s Benefits

- Choose Economy for Larger Transfers:

- Save on fees by opting for the Economy transfer method if time isn’t a constraint.

- Leverage Promotions:

- New users often get promotional offers like fee-free transfers or bonus rates.

- Use Real-Time Tracking:

- Keep the recipient updated on the transfer status through live tracking.

Why Choose Remitly?

- Ease of Use: A simple interface ensures that anyone can quickly send money abroad.

- Transparency: Shows exact fees and exchange rates upfront, avoiding hidden charges.

- Global Reach: Connects you to over 130 countries with flexible delivery methods.

Read Also: 10 Best Passive Income Ideas for Beginners in 2025

10. Xoom

Xoom, a PayPal service, is designed to make international money transfers easy, fast, and secure. Specializing in both personal and business remittances, Xoom offers a variety of services, from bank deposits to cash pickups, making it one of the top choices for users sending money abroad.

How to Use Xoom

- Download the App or Visit the Website:

- You can access Xoom through their mobile app (available on Android and iOS) or the website.

- Create an Account:

- Sign up with your email, set a password, and complete the account verification process.

- Add a payment method, such as a bank account, debit card, or credit card.

- Verify Your Identity:

- Xoom may require verification depending on the amount being sent. Upload documents such as an ID for a smooth transaction process.

- Set Up a Transfer:

- Choose the recipient’s country, the amount you wish to send, and the transfer method (bank deposit, cash pickup, or mobile wallet).

- Complete Your Transfer:

- Review the transfer details and proceed with payment. You’ll receive confirmation, and the recipient will be notified of the transfer’s status.

How to Transfer Money with Xoom

- Select Recipient:

- Enter the recipient’s details, including their bank account or mobile wallet information.

- Choose Payment Method:

- Pick how you want to pay (bank transfer, debit card, or credit card) and how the recipient will receive the money (bank deposit, cash pickup, or mobile wallet).

- Confirm the Transfer:

- Double-check the transaction details and confirm the transfer. For instant transfers, the recipient will get the money almost immediately.

Key Features of Xoom

- Instant Bank Deposits and Cash Pickups:

- Xoom offers instant bank deposits and cash pickups, ensuring your recipient receives the funds as quickly as possible.

- Bill Payments and Mobile Reloads:

- Beyond transfers, Xoom allows users to pay bills or reload mobile phones for family and friends abroad.

- High Transfer Limits:

- Xoom supports higher transfer limits, allowing users to send larger amounts quickly and securely.

- Security and Fraud Protection:

- As a PayPal service, Xoom offers robust security measures, including encryption and fraud protection, to keep your transactions safe.

- Global Coverage:

- Xoom supports transfers to over 130 countries, including popular destinations like India, Mexico, the Philippines, and more.

Who Should Use Xoom?

- Expats and Migrants:

- Ideal for individuals sending money back home to family and friends in their native countries.

- Frequent Travelers:

- Great for those who need to send money while traveling or living abroad.

- Businesses and Freelancers:

- Xoom is a reliable option for businesses or freelancers who need to pay international partners, vendors, or employees.

Tips for Maximizing Xoom’s Benefits

- Use Xoom for Fast Transfers:

- Opt for instant transfer options if you need the money to reach the recipient quickly.

- Pay Bills from Abroad:

- Leverage Xoom’s ability to pay bills, such as utilities or tuition fees, from your home country.

- Track Your Transfers:

- Use Xoom’s tracking feature to monitor your transaction and ensure timely delivery.

Why Choose Xoom?

- Speed: Offers instant transfers, especially for urgent needs.

- Security: Benefit from PayPal’s trusted fraud protection and encryption methods.

- Flexibility: Send money in a variety of ways—bank deposit, cash pickup, or mobile reload.

- Convenience: Transfer money from anywhere, at any time, using the app or website.

How to Choose the Best Money Transfer App

When selecting a money transfer app, consider:

- Fees: Look for transparent pricing with no hidden charges.

- Speed: Ensure the app offers instant or same-day transfers.

- Security: Verify encryption and fraud protection measures.

- Global Reach: If you send money internationally, ensure the app supports the countries you need.

FAQs

1. Which money transfer app is the most secure in the USA?

Apps like PayPal, Zelle, and Apple Pay are highly secure due to encryption, fraud detection, and compliance with banking regulations.

2. Can I send money internationally with these apps?

Yes, apps like Wise, Remitly, and Xoom specialize in international money transfers with competitive rates.

3. Are there fees for transferring money?

Fees vary by app. While Zelle and Google Pay offer free domestic transfers, international apps like Wise charge minimal fees for currency conversion.