Struggling to keep your finances in check? With the ever-changing financial landscape, managing your money effectively has never been more crucial. Discover the top money management tools for 2024 that can transform your financial health and help you stay on top of your finances.

In today’s fast-paced world, keeping track of your income, expenses, and savings can be overwhelming. Without the right tools, it’s easy to lose sight of your financial goals, leading to unnecessary stress and missed opportunities.

That’s where money management tools come in—they streamline the process, providing you with insights and strategies to optimize your finances and achieve your goals.

In this post, we’ll explore the top 10 money management tools for 2024. Each tool is carefully selected based on its features, ease of use, and overall effectiveness in helping you manage your finances. Whether you’re looking to budget better, track your expenses, or invest wisely, there’s a tool on this list for you.

Let’s dive in and find the perfect tool to boost your financial health this year!

Table of Contents

ToggleWhat is Money Management Tool?

A money management tool is a digital application or software designed to help individuals and businesses track, manage, and optimize their finances. These tools typically offer features such as budgeting, expense tracking, bill management, savings goal setting, and investment monitoring.

By providing a clear overview of your financial situation, money management tools make it easier to make informed financial decisions, stay on top of expenses, and work towards financial goals. They are valuable for anyone looking to improve their financial health, from beginners to seasoned investors.

Why Money Management Tool is Important?

Money management tools are important because they help you take control of your finances by providing a clear and organized way to track your income, expenses, savings, and investments.

Here are a few key reasons why these tools are essential:

- Budgeting and Expense Tracking: They enable you to create and stick to a budget, ensuring that you live within your means and allocate your money efficiently.

- Financial Awareness: By giving you a real-time overview of your financial situation, these tools increase your awareness of where your money is going, helping you identify areas where you can cut back or save more.

- Goal Setting: Money management tools allow you to set and track financial goals, such as saving for a vacation, paying off debt, or building an emergency fund, making it easier to achieve them.

- Investment Management: Some tools offer features that help you monitor and manage your investments, providing insights that can help you grow your wealth over time.

- Debt Reduction: By organizing your finances and tracking your debt payments, these tools can help you develop a plan to pay down debt more effectively.

- Stress Reduction: Financial stress is a common issue, and by providing a structured way to manage your money, these tools can help reduce anxiety and give you greater confidence in your financial decisions.

Top 10 Money Management Tools for 2024

Money management tools are essential for individuals seeking to gain control over their personal finances and achieve financial stability.

These tools offer a range of features that streamline budgeting, expense tracking, and financial planning, helping users make informed decisions and reach their financial goals.

The curated list of top money management tools for 2024, designed to help you manage your finances effectively, is provided below:

1. Mint

Mint is a popular and widely-used personal finance app that offers a comprehensive suite of features to help users manage their money effectively.

Launched by Intuit, the same company behind TurboTax and QuickBooks, Mint is designed to provide users with a complete overview of their financial situation in one convenient place.

The app automatically connects to your bank accounts, credit cards, loans, and other financial institutions, aggregating all your financial data into a single dashboard.

This allows you to track your spending, create budgets, monitor your credit score, and set financial goals, all from your smartphone or computer.

Features:

- Mint automatically categorizes and tracks your spending across all connected accounts, providing detailed insights into where your money is going.

- One of Mint’s most powerful features is its budgeting tool. Mint allows you to create customized budgets based on your income and spending habits.

- Mint provides free credit score monitoring, giving you access to your credit score and a breakdown of the factors affecting it.

- Mint can also track your upcoming bills and send reminders so you never miss a payment.

- While Mint’s investment tracking features are somewhat limited, it does provide basic insights into your investment accounts, allowing you to monitor your portfolio’s performance and asset allocation.

Pros

- Free to Use

- User-Friendly Interface

- Comprehensive Overview

Cons

- Ads in the App

- Limited Investment Tracking

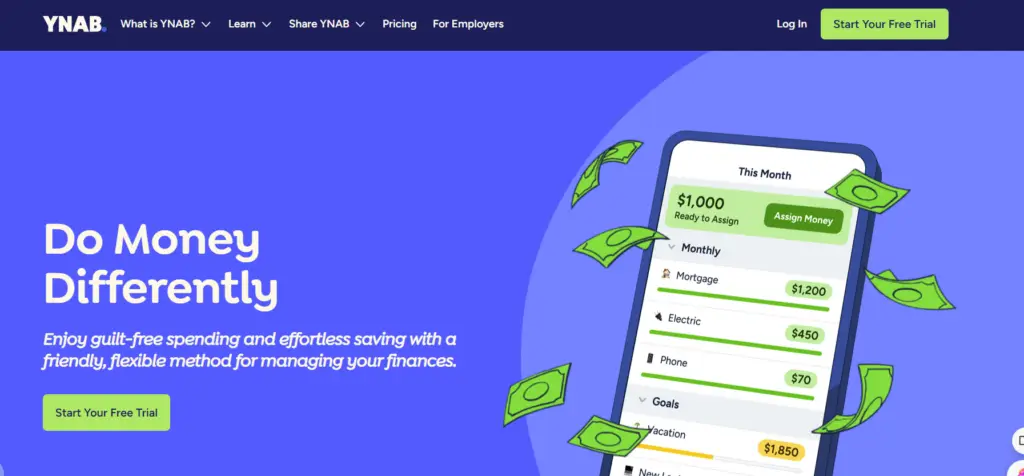

2. YNAB (You Need a Budget)

YNAB, short for You Need a Budget, is a highly regarded budgeting tool designed around a unique and effective budgeting methodology.

Unlike traditional budgeting apps that simply track your spending, YNAB focuses on proactive financial planning, encouraging users to give every dollar a job and prioritize their spending based on their financial goals.

YNAB is designed to change the way you think about money, encouraging you to be intentional with every dollar you earn and spend.

Features:

- Budgeting: YNAB’s core feature is its budgeting tool, which is built around the app’s unique methodology.

- Goal Setting: YNAB allows you to set and track financial goals, whether it’s saving for a vacation, building an emergency fund, or paying off debt.

- Real-Time Syncing: YNAB offers real-time syncing across devices, allowing you to access and update your budget from your computer, smartphone, or tablet.

- Detailed Reporting: YNAB provides detailed reports that give you insights into your spending habits, income trends, and overall financial health.

- Debt Payoff Assistance: YNAB’s budgeting system is particularly effective for those looking to pay off debt.

Pros

- Effective Budgeting Approach

- Strong Customer Support

- Proactive Financial Management

Cons

- Monthly Fee

- Learning Curve

3. Personal Capital

Personal Capital is a robust financial management platform that specializes in investment tracking and financial planning.

Unlike many budgeting apps that focus primarily on tracking day-to-day expenses, Personal Capital takes a more comprehensive approach by integrating both personal finance management and investment oversight into one platform.

Personal Capital’s platform is built around providing a complete picture of your financial health, from daily spending to portfolio performance.

It connects to your bank accounts, credit cards, mortgages, loans, and investment accounts, aggregating all your financial data into a single, easy-to-navigate dashboard.

Features:

- Investment Management: Personal Capital’s standout feature is its investment management tools. The platform offers detailed insights into your investment accounts, allowing you to track portfolio performance.

- Retirement Planning: One of the most powerful tools within Personal Capital is the Retirement Planner. This feature allows you to create a personalized retirement plan based on your financial data, income, and savings goals.

- Budgeting: In addition to its investment tracking capabilities, Personal Capital offers budgeting tools that help you manage your daily finances.

- Net Worth Tracking: Personal Capital provides a real-time view of your net worth, which is calculated by subtracting your liabilities (debts) from your assets (savings, investments, property).

Cash Flow Analysis: The platform includes a cash flow tool that provides a detailed overview of your income and expenses.

Pros

- Comprehensive Financial Overview

- Free Basic Plan

- Investment Insights

Cons

- Some Advanced Features Require a Financial Advisor

- Not Focused Solely on Budgeting

4. EveryDollar

EveryDollar is a budgeting app created by Ramsey Solutions, the company founded by financial expert Dave Ramsey.

The app is designed around the principles of Ramsey’s popular financial advice, particularly the zero-based budgeting method, where every dollar you earn is assigned a specific job in your budget.

EveryDollar aims to simplify the budgeting process, making it accessible for users who want a straightforward way to manage their money without being overwhelmed by complex features.

The app’s clean, intuitive interface makes it easy to create and maintain a budget, track expenses, and set financial goals.

Features:

- Budgeting: The core feature of EveryDollar is its budgeting tool, which uses the zero-based budgeting method. With this system, you start by entering your monthly income and then allocate every dollar to different categories such as housing, transportation, food, savings, and debt repayment.

- Expense Tracking: EveryDollar makes it simple to track your expenses by manually entering transactions or, with the paid version, automatically syncing your bank accounts.

- Goal Setting: EveryDollar includes a goal-setting feature that allows you to set and track financial goals, such as building an emergency fund, paying off debt, or saving for a major purchase.

Debt Payoff Tracking: For users following Dave Ramsey’s Baby Steps, EveryDollar offers tools to help you track your debt payoff progress.

Pros

- Simple Budgeting System

- User-Friendly Interface.

- Encourages Financial Discipline

Cons

- Limited Free Version Features

- Paid Version Required for More Advanced Features

5. GoodBudget

GoodBudget is a digital budgeting app that uses the envelope budgeting system, a traditional method adapted for modern financial management.

Envelope budgeting involves dividing your cash into different “envelopes” or categories for specific spending purposes, such as groceries, transportation, and entertainment.

GoodBudget is designed to provide users with a simple yet effective way to manage their money, offering a clean and intuitive interface that makes it easy to create and maintain a budget.

Features:

- Envelope Budgeting: GoodBudget’s primary feature is its digital envelope budgeting system. You can create virtual envelopes for different spending categories and allocate a specific amount of money to each envelope.

- Expense Tracking: The app includes expense tracking features that allow you to log your transactions and categorize them according to your envelopes.

- Sync Across Devices: GoodBudget supports syncing across multiple devices, which means you can access and update your budget from your smartphone, tablet, or computer.

Budgeting Reports: The app offers basic budgeting reports that provide insights into your spending habits and budget performance.

These reports help you identify trends, assess your progress towards financial goals, and make adjustments to your budget as needed.

Pros

- Digital Envelope System

- Free Basic Plan

- Sync Across Devices

Cons

- Limited Features in the Free Version

- No Investment Tracking

6. PocketGuard

PocketGuard is a budgeting and expense management app designed to help users understand their spending habits, track their expenses, and find opportunities to save money.

The app aims to simplify financial management by providing a clear picture of how much money is available for spending after accounting for bills, goals, and necessities.

PocketGuard’s user-friendly interface and automatic tracking features make it a convenient tool for individuals looking to take control of their finances and optimize their savings.

Features:

- Budgeting: PocketGuard’s budgeting feature helps you create a budget by tracking your income, expenses, and savings goals.

- Expense Tracking: The app offers robust expense tracking capabilities, automatically importing and categorizing transactions from your linked bank accounts and credit cards.

- Savings Goals: PocketGuard allows you to set and track savings goals for various financial objectives, such as building an emergency fund, saving for a vacation, or paying off debt.

In My Pocket: One of PocketGuard’s unique features is the “In My Pocket” function, which shows you how much money you have available for discretionary spending after accounting for bills, goals, and necessities.

Pros

- Easy to Use

- Helps Identify and Save Excess Cash

Cons

- Limited Free Features

- Subscription Required for Full Features

7. Zeta

Zeta is a budgeting and financial management app specifically designed for couples and families, offering tools to manage household finances collaboratively.

The app aims to simplify financial planning for households by providing features that allow multiple users to share and manage their budgets, expenses, and financial goals in one place.

Zeta’s design reflects its commitment to facilitating shared financial management, making it easier for households to stay organized and aligned on their financial goals.

The app’s user-friendly interface and collaborative features make it a valuable tool for managing shared finances and achieving financial harmony within a household.

Features:

- Shared Budgeting: Zeta allows couples and families to create and manage shared budgets, making it easy to allocate funds for common expenses such as rent, utilities, groceries, and family activities.

- Expense Tracking: The app includes comprehensive expense tracking tools that enable users to record and categorize transactions. Zeta supports linking bank accounts and credit cards, allowing for automatic import and categorization of expenses.

- Goal Setting: Zeta offers goal-setting features that help couples and families work towards shared financial objectives.

Collaborative Features: Zeta’s collaborative features are designed to facilitate communication and coordination between users.

Pros

- Designed for Couples and Families

- Free to Use

- User-Friendly Interface

Cons

- Limited to Household Management

- Less Advanced Investment Features

8. Simple

Simple is a financial management app that combines banking services with budgeting tools, offering a seamless integration of both functionalities in one platform.

The app is designed to provide users with an all-in-one solution for managing their money by integrating traditional banking with advanced budgeting features.

Simple aims to simplify financial management by offering users a user-friendly platform where they can manage their spending, save for goals, and handle their banking needs all in one place.

Features:

- Budgeting: Simple includes robust budgeting tools that help users create and maintain a budget with ease. The app allows you to set up budget categories, track your spending, and compare actual expenditures against your budgeted amounts.

- Goal Setting: The app offers goal-setting features that enable users to save for specific financial objectives, such as a vacation, emergency fund, or major purchase.

- Banking Integration: Simple integrates banking services directly into the app, allowing you to manage your bank account, perform transactions, and access banking features without needing to switch between different apps or services.

Expense Tracking: With Simple, users can automatically track and categorize their expenses, making it easier to monitor where their money is going.

Pros

- Integrated with Banking

- Easy Budgeting Tools

- Visual Savings Goals

Cons

- Banking Services Might Not Be Available Everywhere

- Limited Investment Features

9. Clarity Money

Clarity Money is a financial management app that focuses on budgeting, expense tracking, and subscription management. Designed to help users gain control over their finances, the app provides tools to track spending, manage subscriptions, and optimize their budget.

Clarity Money aims to simplify financial oversight by offering a user-friendly platform where individuals can monitor their financial activity, cut unnecessary expenses, and make informed financial decisions.

Features:

- Budgeting: Clarity Money offers comprehensive budgeting tools that allow users to create and manage budgets effectively.

- Expense Tracking: The app includes features for tracking your expenses by automatically categorizing and recording transactions from linked bank accounts and credit cards.

Subscription Management: One of Clarity Money’s standout features is its subscription management tool.

Pros

- Helps Manage Subscriptions

- Easy to Use

Cons

- Limited Investment Tracking

- Some Features Require a Subscription

10. Tiller Money

Tiller Money is a financial management tool that leverages the power of spreadsheets for budgeting and financial tracking.

Unlike traditional budgeting apps that use pre-built templates and interfaces, Tiller Money offers a spreadsheet-based approach, allowing users to create highly customized financial models tailored to their specific needs.

Tiller Money aims to offer detailed, customizable budgeting solutions by automatically updating your spreadsheets with financial data from your linked bank accounts and credit cards.

This integration helps users maintain up-to-date records of their transactions and balances, facilitating more precise and personalized financial management.

Features:

- Customizable Spreadsheets: Tiller Money’s core feature is its customizable spreadsheet templates. Users can start with pre-designed templates or create their own spreadsheets to fit their unique budgeting and financial tracking needs.

- Automatic Updates: The app offers automatic updates to your spreadsheets by linking directly to your bank accounts and credit cards.

Integration with Google Sheets and Excel: Tiller Money integrates with both Google Sheets and Microsoft Excel, making it accessible to users who prefer either platform.

Pros

- Highly Customizable

- Integrates with Google Sheets and Excel

Cons

- Monthly Fee

- Requires Spreadsheet Knowledge